From Lagos to Johannesburg, where African CMOs are discovering that the measurement frameworks built for mature Western markets often mislead rather than illuminate in African contexts. While global CMOs rely on standardised KPIs developed in stable economies, African markets demand a fundamentally different approach, one that accounts for mobile-first consumers who research on Instagram but buy from street vendors, economies where a customer’s spending power can fluctuate based on harvest seasons, and communities where WhatsApp group recommendations carry more weight than celebrity endorsements.

The cost of measurement misalignment is steep. African businesses that persist with Western-centric KPIs report higher customer acquisition costs and lower campaign effectiveness than those that’ve adapted their metrics for continental realities. More critically, they miss the massive opportunities hidden in Africa’s unique consumer behaviours, economic patterns, and cultural dynamics that can drive exceptional business growth when properly understood and measured.

Customer Acquisition Cost (CAC)

Customer Acquisition Cost in African markets reveals complexities that global averages cannot capture. The cost to acquire a customer in Nairobi’s tech hubs differs dramatically from rural farming communities in Uganda, not just in absolute terms but in the fundamental strategies required for successful acquisition. African CMOs must understand that CAC varies not only by geography but by purchasing power segments, infrastructure accessibility, and cultural contexts that influence how consumers discover and evaluate brands.

The mobile-first reality of African markets adds layers of complexity to CAC calculations that don’t exist in developed economies. While traditional digital marketing focuses on web-based acquisition funnels, African acquisition often involves SMS campaigns, mobile money integration, and WhatsApp Business interactions that create unique cost structures. In markets like Kenya where M-Pesa dominates, acquisition costs must factor in mobile money transaction fees and the premium consumers place on seamless mobile payment integration. Meanwhile, in markets with lower smartphone penetration, successful acquisition might require blending mobile and traditional media in ways that challenge conventional attribution models.

The mobile-first reality of African markets adds layers of complexity to CAC calculations that don’t exist in developed economies. While traditional digital marketing focuses on web-based acquisition funnels, African acquisition often involves SMS campaigns, mobile money integration, and WhatsApp Business interactions that create unique cost structures. In markets like Kenya where M-Pesa dominates, acquisition costs must factor in mobile money transaction fees and the premium consumers place on seamless mobile payment integration. Meanwhile, in markets with lower smartphone penetration, successful acquisition might require blending mobile and traditional media in ways that challenge conventional attribution models.

Language diversity significantly impacts CAC across African markets, where campaigns in local languages often deliver lower acquisition costs but require market-specific creative development and media strategies. A campaign that works cost-effectively in English-speaking Lagos might need complete restructuring for Yoruba-speaking communities in the same city. The informal economy adds another dimension, as many African consumers make purchasing decisions through community networks and personal recommendations that don’t fit traditional acquisition tracking methods. Smart African CMOs develop CAC models that account for word-of-mouth amplification and community-based acquisition patterns that can dramatically improve cost efficiency when properly understood and optimised.

Economic volatility creates additional CAC considerations unique to African markets. Currency fluctuations can make acquisition campaigns profitable one month and unsustainable the next, requiring dynamic CAC targets that adjust for macroeconomic conditions. Successful African marketers build buffer zones into their CAC planning and develop acquisition strategies that remain viable during economic uncertainty, often focusing on value propositions that transcend short-term price sensitivity.

Customer Lifetime Value (CLV)

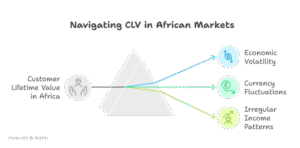

Customer Lifetime Value calculations in African markets require fundamental adjustments to account for economic realities that don’t exist in stable developed economies. Traditional CLV models assume relatively predictable income patterns and currency stability, assumptions that simply don’t hold across most African markets. Economic volatility, currency fluctuations, and irregular income patterns create CLV measurement challenges that demand innovative approaches to customer value assessment.

The irregular income cycles common across African economies significantly impact how CLV should be calculated and interpreted. Agricultural communities experience seasonal income flows that create predictable but non-linear spending patterns, while urban informal sector workers face unpredictable earning cycles that affect their purchasing behaviour. Even formal sector employees often supplement irregular salaries with side businesses, creating complex income profiles that traditional monthly or quarterly CLV models fail to capture. African CMOs need CLV frameworks that account for these spending volatilities and seasonal purchasing behaviours while still providing actionable insights for customer retention strategies.

The irregular income cycles common across African economies significantly impact how CLV should be calculated and interpreted. Agricultural communities experience seasonal income flows that create predictable but non-linear spending patterns, while urban informal sector workers face unpredictable earning cycles that affect their purchasing behaviour. Even formal sector employees often supplement irregular salaries with side businesses, creating complex income profiles that traditional monthly or quarterly CLV models fail to capture. African CMOs need CLV frameworks that account for these spending volatilities and seasonal purchasing behaviours while still providing actionable insights for customer retention strategies.

Currency instability adds another critical dimension to African CLV calculations. A customer base that appears highly valuable when measured in local currency might show concerning CLV trends when converted to hard currencies, particularly during periods of rapid devaluation. Sophisticated African marketers develop dual-currency CLV models that help them understand both local market performance and broader business sustainability. This becomes particularly important for businesses operating across multiple African markets, where currency performance varies significantly and can impact overall portfolio profitability.

The impact of remittances creates unique CLV opportunities and challenges in African markets with significant diaspora populations. Customer spending power often depends on money transfers from relatives abroad, creating CLV patterns that fluctuate based on economic conditions in destination countries and regulatory changes in transfer mechanisms. Understanding these remittance patterns and incorporating them into CLV calculations helps African CMOs better predict customer behaviour, optimise retention strategies, and identify high-value customer segments that might not be apparent through traditional demographic analysis.

Mobile money integration and digital financial services adoption also influence CLV in distinctly African ways. Customers who adopt mobile banking and payment services often show different retention and spending patterns than cash-only customers, creating CLV segments that correlate with digital adoption rather than just income levels. This digital divide in CLV performance helps African marketers prioritise customer education and digital onboarding initiatives that can significantly improve long-term customer value.

Campaign Return On Investment (ROI)

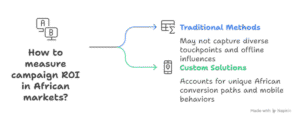

Campaign ROI measurement in African markets requires accounting for attribution complexities that don’t exist in more developed digital ecosystems. The typical customer journey spans online discovery, offline research through community networks, mobile-based price comparison, and often cash-based transactions that challenge traditional ROI tracking methods. African CMOs must build ROI measurement systems that capture value creation across these diverse touchpoints while acknowledging that much of the influence and conversion happens outside digital tracking systems.

The prevalence of mobile-first consumer behaviour creates both opportunities and challenges for ROI measurement. While mobile campaigns can be tracked more precisely than traditional media, the mobile ecosystem in Africa involves platforms and behaviours that don’t align with standard analytics tools. WhatsApp Business conversations, mobile money transactions, and social commerce through platforms like Instagram and Facebook require custom ROI tracking solutions that account for African-specific conversion paths. Campaigns that appear to have poor ROI based on traditional web analytics might actually be driving significant value through mobile channels that aren’t captured in standard measurement frameworks.

The prevalence of mobile-first consumer behaviour creates both opportunities and challenges for ROI measurement. While mobile campaigns can be tracked more precisely than traditional media, the mobile ecosystem in Africa involves platforms and behaviours that don’t align with standard analytics tools. WhatsApp Business conversations, mobile money transactions, and social commerce through platforms like Instagram and Facebook require custom ROI tracking solutions that account for African-specific conversion paths. Campaigns that appear to have poor ROI based on traditional web analytics might actually be driving significant value through mobile channels that aren’t captured in standard measurement frameworks.

Economic volatility significantly impacts campaign ROI interpretation in African markets. A campaign launched during a stable economic period might show excellent ROI, while the same campaign during currency devaluation or political uncertainty could appear unsuccessful despite identical execution quality. African marketers need ROI frameworks that adjust for macroeconomic factors and help distinguish between campaign performance issues and external economic impacts. This contextual ROI analysis becomes crucial for budget allocation decisions and campaign optimisation strategies.

The informal economy’s influence on campaign ROI creates measurement blind spots that can lead to misguided strategic decisions. Campaigns that drive awareness and consideration in formal channels might ultimately convert through informal distribution networks that don’t report back to traditional tracking systems. Street vendors, local markets, and community-based retailers often serve as the final conversion point for campaigns initiated through digital or traditional media. Sophisticated African CMOs develop hybrid ROI measurement approaches that combine formal tracking with community-based research and informal channel feedback to capture true campaign impact.

Cultural seasonality and local events significantly impact campaign ROI in ways that global frameworks don’t anticipate. Religious observances, agricultural cycles, and local political developments can dramatically influence campaign performance within short timeframes. ROI measurement systems that don’t account for these cultural and economic rhythms might misinterpret campaign performance and lead to poor optimisation decisions. Successful African marketers build cultural context into their ROI analysis, understanding that timing and relevance often matter more than creative quality or media spend efficiency.

Customer Retention Rate (CRR)

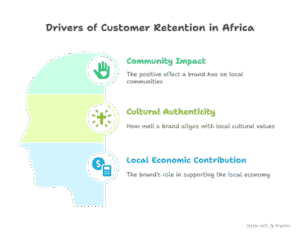

Customer Retention Rate in African markets reflects unique loyalty drivers that extend far beyond product satisfaction and pricing considerations. African consumers often base retention decisions on community impact, cultural authenticity, and local economic contribution in ways that traditional retention models don’t capture. Brands that invest meaningfully in local communities, employ local talent, and demonstrate genuine cultural understanding frequently achieve retention rates that exceed what their product quality or pricing would predict in other markets.

Economic volatility creates retention challenges and opportunities that don’t exist in stable markets. During economic downturns, consumers might switch to cheaper alternatives, but they also often increase loyalty to brands that help them navigate difficult periods through flexible payment terms, community support, or value-added services. African CMOs need retention measurement systems that distinguish between price-driven churn and relationship-based retention, understanding that economic pressures can either strengthen or weaken customer relationships depending on how brands respond to community needs.

Economic volatility creates retention challenges and opportunities that don’t exist in stable markets. During economic downturns, consumers might switch to cheaper alternatives, but they also often increase loyalty to brands that help them navigate difficult periods through flexible payment terms, community support, or value-added services. African CMOs need retention measurement systems that distinguish between price-driven churn and relationship-based retention, understanding that economic pressures can either strengthen or weaken customer relationships depending on how brands respond to community needs.

The mobile-first nature of African consumer interaction creates unique retention dynamics that traditional models struggle to capture. Customer retention often depends on mobile experience quality, data efficiency, and mobile payment integration rather than just product performance. In data-constrained environments, brands that provide fast, lightweight mobile experiences often achieve better retention than those with feature-rich but data-heavy alternatives. Mobile money integration becomes a retention factor in markets where seamless payment experiences create switching costs that go beyond traditional loyalty programs.

Community network effects significantly influence retention rates in African markets where purchasing decisions are often community-based. A customer who might individually consider switching brands could remain loyal due to community preferences, family recommendations, or local social pressures. Conversely, community-wide brand switching can create retention challenges that individual customer service excellence cannot overcome. Understanding these community dynamics helps African marketers develop retention strategies that work at both the individual and community levels.

Language and cultural relevance impact retention in ways that global brands often underestimate. Customers who feel genuinely understood and represented by brands often show retention rates that exceed economic rationality, while brands that appear culturally tone-deaf face retention challenges even when offering superior products or pricing. This cultural dimension of retention requires measurement approaches that go beyond transaction analysis to include cultural sentiment monitoring and community feedback assessment.

Seasonal income patterns create retention measurement complexities unique to African markets. Customers might appear to churn during certain periods when they’re actually just experiencing temporary income constraints. Agricultural communities show predictable retention patterns tied to harvest cycles, while urban informal workers face unpredictable retention fluctuations based on business conditions. African CMOs need retention measurement frameworks that distinguish between temporary economic churn and permanent brand abandonment, allowing for retention strategies that account for income volatility.

Share of Voice vs. Share of Market (SOV/SOM)

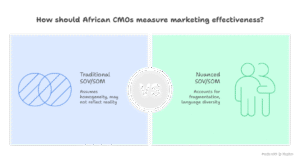

The relationship between Share of Voice and Share of Market in African contexts reveals dynamics that challenge conventional marketing wisdom developed in mature markets. Traditional SOV/SOM analysis assumes relatively homogeneous media consumption and competitive landscapes, assumptions that don’t hold across African markets where media fragmentation, language diversity, and the informal economy influence create complex competitive dynamics that require nuanced measurement approaches.

Language diversity fundamentally alters SOV measurement across African markets, where brands might dominate English-language conversations while remaining invisible in local language discussions that drive actual purchasing decisions. In Nigeria, a brand could achieve strong SOV in English-language media while competing brands dominate Hausa, Yoruba, or Igbo conversations. This linguistic fragmentation means that effective SOV measurement requires multilingual monitoring that captures brand presence across all relevant language communities within target markets. The relationship between linguistic SOV and actual market share often reveals surprising disconnects that can guide strategic communication investments.

The informal economy’s influence creates SOV/SOM measurement challenges that don’t exist in formal retail-dominated markets. Brands might achieve strong SOV in formal media channels while competitors dominate informal distribution networks and community conversations that drive market share. Traditional media monitoring captures brand mentions in newspapers, radio, and digital platforms, but misses the word-of-mouth influence that occurs in markets, taxi ranks, and community gatherings where many purchasing decisions are influenced. African CMOs need SOV measurement frameworks that blend formal media monitoring with community-based influence tracking.

Mobile-first media consumption patterns create SOV opportunities and measurement complexities unique to African markets. WhatsApp groups, Facebook communities, and mobile-optimised platforms often carry more influence than traditional media in driving market share, yet these conversations can be difficult to monitor comprehensively. The relationship between mobile SOV and market share frequently shows different patterns than traditional media SOV, requiring marketers to develop mobile-specific measurement approaches that capture influence across messaging apps, social commerce platforms, and mobile-optimised content.

Cultural seasonality significantly impacts SOV/SOM relationships in African markets where local events, religious observances, and agricultural cycles create predictable but intense competition for consumer attention. During cultural celebrations or agricultural seasons, SOV requirements for maintaining market share might increase dramatically as competitors intensify their communication efforts. Understanding these seasonal SOV/SOM dynamics helps African marketers optimise their communication timing and intensity to maintain a competitive position during critical periods.

Economic conditions create additional SOV/SOM complexity in African markets where currency devaluation or economic uncertainty can rapidly shift consumer behaviour and competitive dynamics. During economic stress, consumers often become more receptive to value-focused messaging, potentially altering the SOV requirements for maintaining market share. Brands that adjust their SOV strategies to match economic conditions often achieve better SOV/SOM efficiency than those that maintain consistent communication approaches regardless of economic context.

Mastering African Marketing Measurement

These five KPIs, when properly adapted for African market realities, provide CMOs with measurement frameworks that capture the true drivers of business success across the continent. The key lies not in applying global benchmarks, but in understanding how African market characteristics, economic volatility, mobile-first behaviour, community influence, language diversity, and cultural seasonality, create unique measurement requirements that demand innovative approaches to marketing performance assessment.

Ready to transform your marketing measurement for African market success?

At Marketing Analytics Africa, we’re dedicated to equipping African businesses, marketers, and innovators with the insights and tools to thrive in the data and AI revolution.

Follow us Join over 2,000 African marketing leaders who receive our weekly insights on continental best practices, case studies, and measurement frameworks that drive real results. Subscribe to our newsletter for exclusive reports, webinars, and trend analyses. Partner with us to tell your brand’s data-driven success story across the continent.