Are you spending ₦500,000+ monthly on social media marketing but don’t know if your 1% engagement rate is good or terrible?

You’re not alone.

For years, Nigerian marketers have been making million-naira decisions based on benchmarks from the Western markets with completely different audience behaviours, platform preferences, and content consumption patterns.

That changes today.

We’ve just completed the first comprehensive analysis of social media performance by Nigerian brands, examining 2,542 posts from 83 leading companies across 5 major industries. What we discovered will fundamentally change how you approach social media marketing in Nigeria.

The Problem: You have Been Using the Wrong Benchmarks

- When you Google “average Instagram engagement rate,” you get results like:

- “Instagram engagement averages 0.83%”

- “Good engagement is 1-3%”

- “Post daily for best results”

But here’s the critical question: Is that data from Nigerian brands or Western brands?

The answer? Almost always American or European brands.

And Nigerian audiences behave differently:

- Different platform preferences

- Different content consumption habits

- Different engagement patterns

- Different cultural contexts

Using global benchmarks for Nigerian strategy is like using a map of London to navigate Lagos; you might eventually get somewhere, but you’ll definitely get lost along the way.

What We Discovered (And Why It Matters)

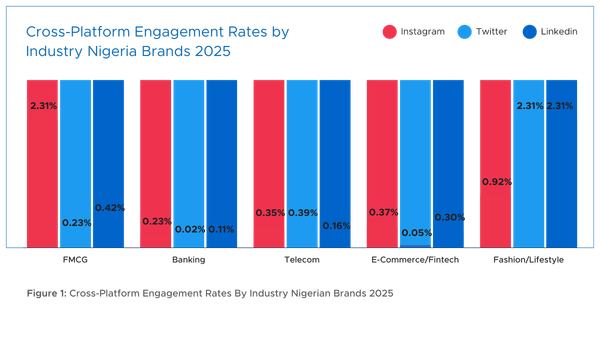

After analysing 83 Nigerian brands across FMCG, Banking, Telecommunications, E-commerce, and Fashion sectors, we uncovered findings that challenge nearly everything the industry has been teaching about social media marketing in Nigeria.

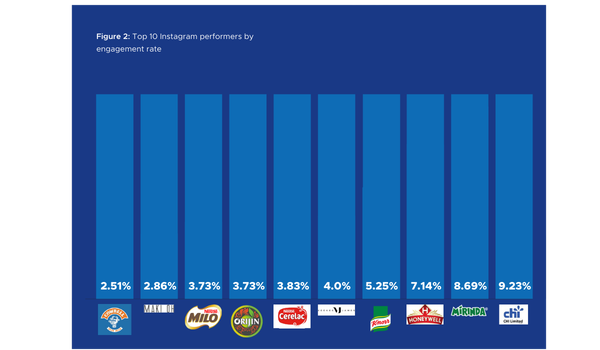

Finding #1: Follower Count is Dead as a Metric

One of our most shocking discoveries: Follower count has virtually no correlation with engagement success in Nigeria. We found brands with under 30,000 followers achieving 9%+ engagement rates, while brands with 700,000+ followers barely managed 1.5%.

Small brands are consistently outperforming massive global corporations. Not because of the budget. Not because of advertising spend. But because of the content strategy.

Question for you: Are you still measuring success by follower count? Or have you shifted to engagement quality?

Finding #2: Your Posting Frequency is Probably Wrong

Industry “experts” tell you to post daily. Some even say multiple times per day. Nigerian data tells a different story.

We compared brands posting different frequencies and found a surprising pattern. We found that conventional wisdom about posting frequency is completely wrong for Nigerian audiences.

The brands achieving the highest engagement in our study follow a posting pattern that most marketers would consider “too infrequent.” Yet their results speak for themselves.

Want to know the optimal posting frequency for your industry? Get the full report.

Finding #3: Your Industry Benchmarks Change Everything

Here’s why you need Nigerian-specific benchmarks:

A Banking brand with 0.5% engagement might think they’re underperforming. But what if we told you that it could actually be excellent performance for the banking sector in Nigeria?

We discovered engagement rate variations across industries that are 10x different. Ten times.

If you’re comparing yourself to brands in different industries, you’re comparing apples to oranges. You need to know:

- What’s the average engagement rate for YOUR industry?

- Which Nigerian brands in your sector are winning (and what they’re doing differently)?

- Where do you rank against your actual competitors?

The full report breaks down exact benchmarks for 5 industries. Learn more.

Finding #4: Platform Performance Isn’t What You Think

Instagram, Twitter (X), and LinkedIn all perform differently in Nigeria, dramatically differently.

One platform delivers 9 times higher engagement than another for Nigerian brands. Nine times.

If you’re splitting your budget evenly across platforms, you’re almost certainly misallocating resources. Some platforms work incredibly well in Nigeria. Others are barely worth the investment.

But which is which? The full report includes platform-by-platform performance data.

Finding #5: Video vs. Static Content (The Data Will Surprise You)

Everyone says “video is important.” But how important for Nigerian audiences specifically?

We measured engagement rates for video posts versus static image posts across 83 brands. The performance difference? Let’s just say if you’re posting mostly static images, you’re leaving massive engagement on the table.

The brands achieving the highest engagement rates in our study have shifted to a video-first strategy. Not because video is trendy. But because Nigerian audiences overwhelmingly prefer it.

Exact video performance data is in the full report. Download here.

Finding #6: The LinkedIn Opportunity Nobody’s Taking

Over half the brands we analysed have zero LinkedIn presence. None.

Meanwhile, brands active on LinkedIn in Nigeria are seeing engagement rates that rival their Instagram performance, on a platform where most competitors aren’t even competing. For B2B brands, fintech companies, professional services, and corporate-focused businesses, this represents a blue ocean opportunity.

While everyone fights for attention on crowded Instagram feeds, LinkedIn in Nigeria is wide open.

Our report includes detailed LinkedIn adoption rates and performance benchmarks. Access the data.

Why This Research is Different

- Actual Nigerian Brand Data: Not western estimates or averages. Real performance data from 83 Nigerian brands.

- Industry-Specific Benchmarks: FMCG, Banking, Telecom, E-commerce, and Fashion—each broken down separately.

- November 2025 Data: Current data, not outdated statistics from 2023 or 2024.

- Platform-by-Platform Analysis: Instagram, Twitter, and LinkedIn performance compared head-to-head.

- Content Type Performance: Video vs. static images vs. carousels, which performs best in Nigeria?

- Winner Case Studies: Deep dives into the brands achieving 5x+ better engagement than their competitors.

The Bottom Line

For years, Nigerian marketers have been making million-naira decisions based on data from markets that don’t look like ours, don’t behave like ours, and don’t engage like ours. The Nigerian Social Media Benchmarks 2025 Report gives you what you’ve been missing: actual Nigerian data. Not estimates. Not projections. Not adapted Western research. Real performance data from 83 brands across FMCG, Banking, Telecom, E-commerce, and Fashion.

You’ll know exactly where your brand stands. You’ll see what’s working for competitors in your industry. You’ll stop guessing and start knowing. If you’re spending hundreds of thousands monthly on social media but don’t have Nigerian benchmarks to guide your strategy, you’re flying blind. This report is your map.